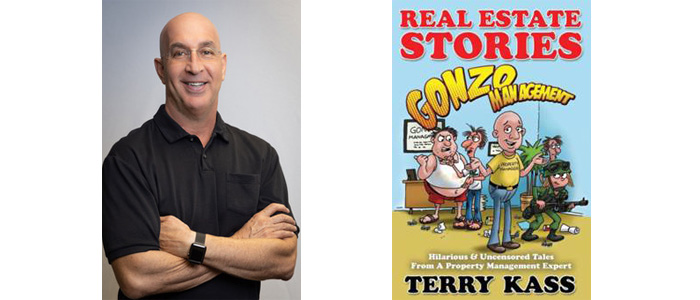

If you’re interested in learning more about investing in small to mid-sized Arizona apartment complexes, Terry Kass is a local real estate specialist you’ll want to call. Terry is a partner and designated broker with GPCI Multifamily and Land Development in Scottsdale.

Throughout Terry’s 25-year career in the multifamily sector, he has focused on advisory and brokerage of small to mid-sized apartments in the greater Phoenix market. Terry has closed more than 500 multifamily transactions and holds the prestigious designations of the CCIM (Certified Commercial Investment Manager) and CPM (Certified Property Manager). He’s also a renowned real estate educator, speaker, and author of “Real Estate Stories: Gonzo Management. Hilarious & Uncensored Tales From a Property Management Expert.”

His hilarious and uncensored tales of being a property manager will appeal to anyone who wants a good laugh, but will definitely appeal to the thousands of Phoenix-area real estate agents, brokers, property managers, and anyone who is a landlord or thinking of becoming one. Some of the chapters in Terry’s book include such titles as: “Drug Dealers 101,” “My Date with Phoenix SWAT,” and “Inspections or I Would Rather Have a Tooth Pulled with No Shots.”

Terry will tell you that investing in two-unit to four-unit apartment buildings is a smart, “low barrier to entry” starting point to develop a real estate portfolio for beginner investors as well as those interested in pivoting from investing in single family homes to multi-family buildings. His four compelling reasons include:

- FINANCING: 4 units or less can qualify for residential financing through a local lender. This is important for beginners because rates tend to be more attractive and the loan underwriting process depends more on the financial wherewithal of the borrower, less on the rental profile of the building.

- PROPERTY MANAGEMENT: Smaller buildings are much easier to manage and often owners will manage the property themselves, saving on the expense of a property manager.

- RESALE: Because it is a smaller asset and more affordable, there is usually a robust market for resales.

- DIVERSIFICATION: Apartment buildings often offer an investor a way to diversify his or her balance sheet or net worth and add real estate to stocks, bonds and cash. It also can provide excellent passive income to hedge against future “unemployment” whether that includes a career switch or retirement.

“I’ve been investing in apartment complexes for 25 years and love it,” says Terry. “There are ups and downs, but when done right, it can prove to be a great experience, as well as a good, solid cash flowing investment. And as my father always said, more millionaires come from real estate than from anywhere else.”

To speak with Terry Kass, call him at 602-703-5277. For more information about GPCI Multifamily and Land Development, visit gpcimultifamily.com.

Lila Baltman is the owner of Lila Rose Baltman Public Relations.